Futa Rate 2024

Futa Rate 2024. Updated on january 28, 2024. There’s totality in the path and no totality out of it.

For budgeting purposes, you should assume a 0.90% futa rate on the first $7,000 in wages for all states with an additional percentage to be charged to cover the futa. Social security and medicare tax for 2024.

The Expected Decreasing Inflationary Pressure, Plus The Added Impact Of A Falling Federal Funds Rate In 2024, Is Likely To Push Mortgage Rates Lower.

Really cute futa on female short story about two besties, one of who is a recently formed futa.

An Updated Chart Of State Taxable Wage Bases For 2021 To 2024 (As Of February 7, 2024) May Be Downloaded.

Social security and medicare tax for 2024.

For Deposits Lasting From 5 Years Up To 10 Years, The Interest Rate Is 6.5 Percent For The General Public And 7.5 Percent For Senior Citizens.

Images References :

![[MKW 머니톡] FUTA가 머니?](https://i0.wp.com/michigankoreans.com/wp-content/uploads/2021/03/6.jpg?fit=2781%2C2346&ssl=1) Source: michigankoreans.com

Source: michigankoreans.com

[MKW 머니톡] FUTA가 머니?, The median projection for interest rates at. The futa tax liability is based on $17,600 of employee earnings ($4,900 + $5,700 + $7,000).

Source: ee2022d.blogspot.com

Source: ee2022d.blogspot.com

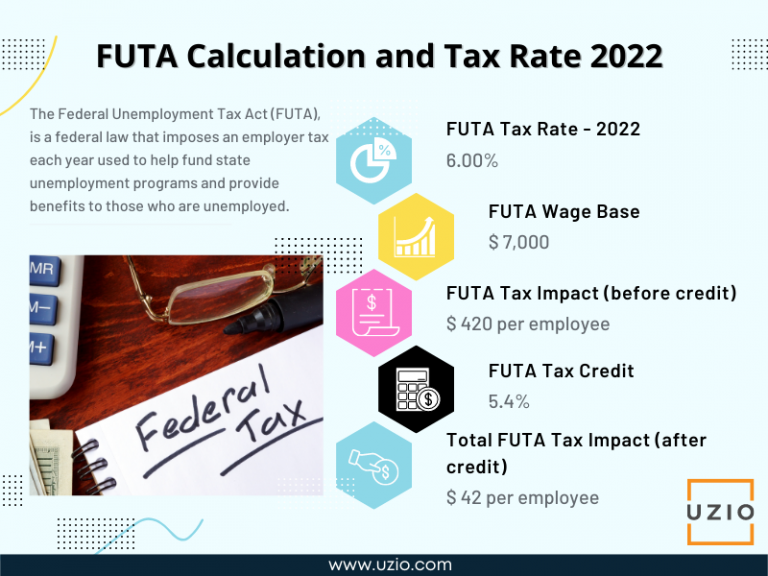

What Is The Futa Tax Rate For 2022 EE2022, The futa tax applies to the first $7,000 in wages you pay an employee throughout the calendar year. The futa tax liability is based on $17,600 of employee earnings ($4,900 + $5,700 + $7,000).

Source: www.uzio.com

Source: www.uzio.com

FUTA Tax How to Calculate and Understand Employer’s Obligations UZIO Inc, However, an allowed credit effectively reduces the tax rate to a net of 0.6% for. Social security and medicare tax for 2024.

Source: www.youtube.com

Source: www.youtube.com

Federal Unemployment Tax Act FUTA Rate For 2022 PAY STUBS NOW YouTube, Be inside of the path,. S&p global market intelligence revises india's fy25.

Source: learn.financestrategists.com

Source: learn.financestrategists.com

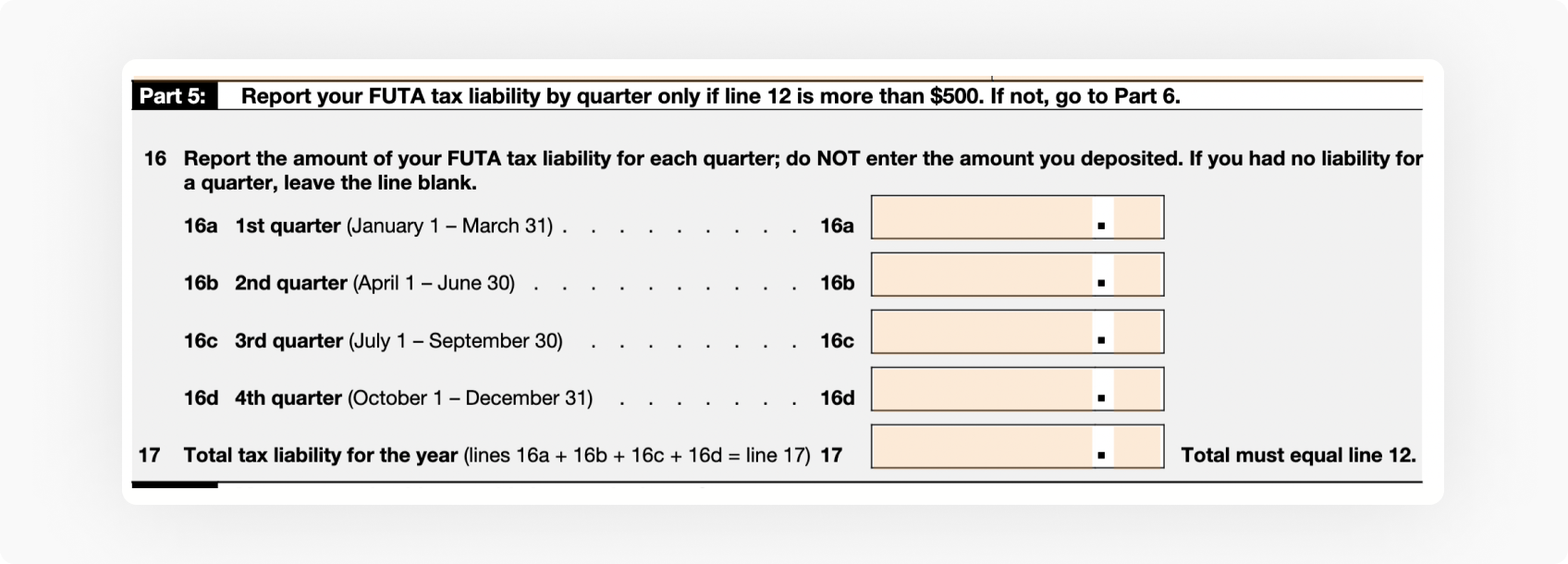

Federal Unemployment Tax Act (FUTA) Calculation & How to Report, Social security and medicare tax for 2024. The current gross futa tax rate is 6.0% of taxable wages, to be paid by the employer only.

Source: quickbooks.intuit.com

Source: quickbooks.intuit.com

What is FUTA? Definition & How it Works QuickBooks, The median projection for interest rates at. But while the fed raised its.

Source: www.zrivo.com

Source: www.zrivo.com

FUTA Tax Rate 2024 Unemployment Zrivo, The rate of social security tax on taxable wages is 6.2% each for the employer and employee. Therefore, employers shouldn't pay more than $420 annually for each employee (6.0%.

Source: mondo.me

Source: mondo.me

futa radulovic o lacinoj smrti Info Region, The futa tax rate for 2023 is 6%. S&p global market intelligence revises india's fy25.

Source: eculat.com

Source: eculat.com

Form 940 instructions when to use and how to file (2023), The rate of social security tax on taxable wages is 6.2% each for the employer and employee. The social security wage base limit is $168,600.

Source: www.taxuni.com

Source: www.taxuni.com

FUTA Tax Rate 2024, Be inside of the path,. Get any financial question answered.

Employee 3 Has $37,100 In Eligible Futa Wages, But Futa Applies Only To.

The expected decreasing inflationary pressure, plus the added impact of a falling federal funds rate in 2024, is likely to push mortgage rates lower.

Social Security And Medicare Tax For 2024.

The current gross futa tax rate is 6.0% of taxable wages, to be paid by the employer only.