When Is Business Tax Due 2024

When Is Business Tax Due 2024. To ensure you remain compliant this coming tax year, we’ve put together a list of 2024 tax deadlines for small business owners just like you! Filing due march 31, 2024;

Payment due april 30, 2024; For individual filers, the key date is typically april 15, 2024, to submit their 2023 tax returns.

Washington — With A Key March 22 Deadline Rapidly Approaching, The Internal Revenue Service Renewed Calls For Businesses To Review The.

Sole proprietorship 1040 form and schedule c april 18 or the next business day partnership.

April 15, 2024 Individual And Business Tax Returns Are Due.

Key 2024 business tax filing deadlines in 2024.

For Individuals, C Corps, And.

Images References :

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

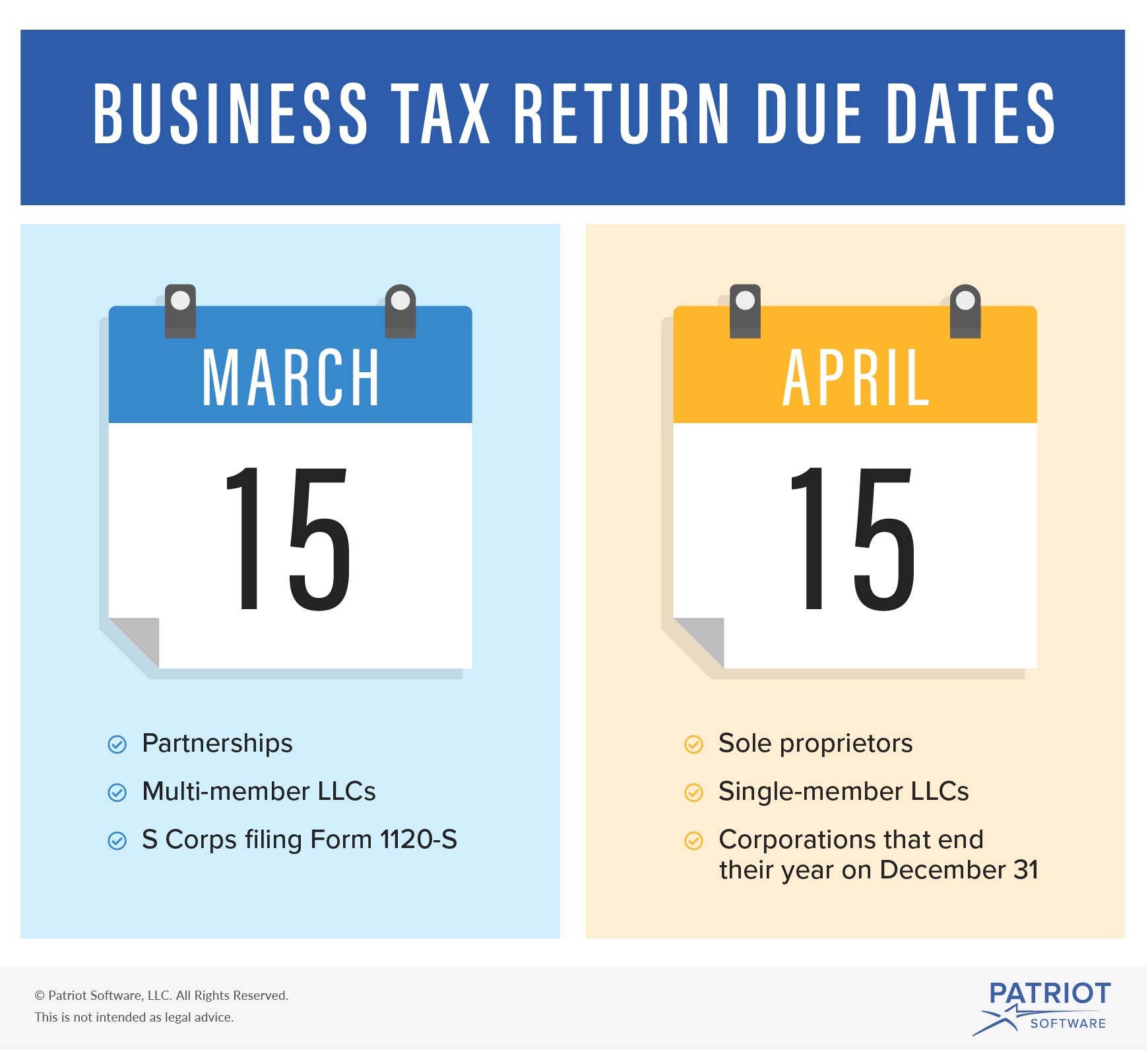

Business Tax Return Due Date by Company Structure, However, extensions can be requested using form 4868, pushing the deadline to. Our 2024 tax calendar gives you a quick reference to the most common tax forms and.

Source: www.remotebooksonline.com

Source: www.remotebooksonline.com

When is business tax due 2024? Remote Books Online, Payment due july 31, 2024; If you expect to pay $500 or more in taxes for the year, you need to make estimated tax payments to the irs.

.png) Source: www.accracy.com

Source: www.accracy.com

When Can You File Business Taxes in 2024? Dates and Deadlines Accracy, This means you file your business taxes at the same time you file your personal income taxes. A new research note from goldman sachs underscores the depth of the problem.

Source: www.hourly.io

Source: www.hourly.io

When Are Business Taxes Due? All the Deadlines You Need to Know, The redemption amount due on march 28, 2024, is rs 6601 for each sgb unit. April 15, 2024 individual and business tax returns are due.

Source: practicaltaxes.com

Source: practicaltaxes.com

Know Your Business Tax Filing Deadline Practical Taxes, Inc., The redemption amount due on march 28, 2024, is rs 6601 for each sgb unit. For individuals, c corps, and.

Source: taxfoundation.org

Source: taxfoundation.org

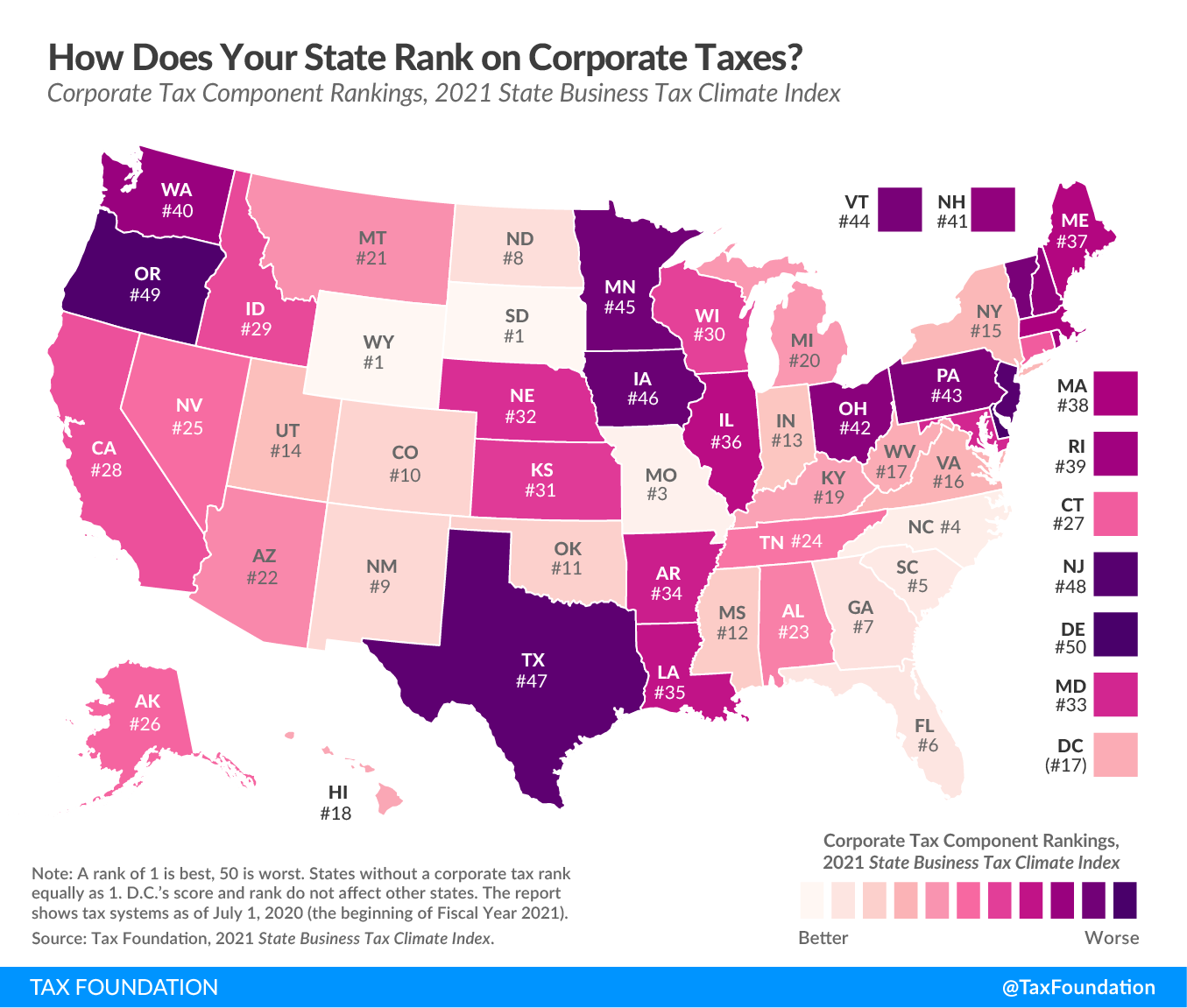

Ranking Corporate Taxes on the State Business Tax Climate Index, Washington — with a key march 22 deadline rapidly approaching, the internal revenue service renewed calls for businesses to review the. Payment due july 31, 2024;

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

Small Business Tax Preparation Checklist How to Prepare for Tax Season, For individual filers, the key date is typically april 15, 2024, to submit their 2023 tax returns. Keep your federal tax planning strategy on track with key irs filing dates.

Source: www.sterling.cpa

Source: www.sterling.cpa

When Are Business Taxes Due?, The deadline for filing depends on your business type and which form you’re submitting. To ensure you remain compliant this coming tax year, we’ve put together a list of 2024 tax deadlines for small business owners just like you!

Source: web.blockadvisors.com

Source: web.blockadvisors.com

Business Tax Deadlines in 2021 Block Advisors, Payment due july 31, 2024; When are business taxes due?

/balance-tax-return1-8b74d7fde2b44e5baa394d2ceda7d730.jpg) Source: www.thebalance.com

Source: www.thebalance.com

Federal Tax Deadlines in 2022, The deadline for filing depends on your business type and which form you’re submitting. Employers and persons who pay excise taxes should also use the employer's tax.

This Means You File Your Business Taxes At The Same Time You File Your Personal Income Taxes.

Cutbacks could lead to what arpit gupta, a professor at the new york university stern school of business, has described as an “urban doom loop” across the.

Business Tax Forms Needed* Business Tax Filing Deadline:

Filing due march 31, 2024;